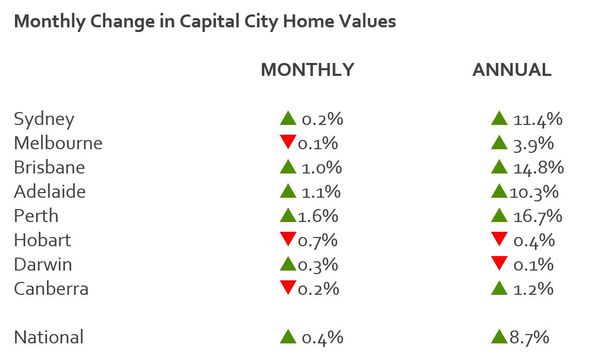

Australia’s housing upswing continued through the first month of 2024 with CoreLogic’s national Home Value Index (HVI) rising 0.4% in January. Up from the 0.3% increases seen in November and December, this marks the 12th straight month of value rises.

Beneath the headline result, housing market performance remains diverse around the country. Three capitals recorded a subtle decline over the month (Melbourne -0.1%, Hobart -0.7% and Canberra -0.2%), while, Perth, Adelaide and Brisbane values continued to rise at the monthly rate of 1% or more.

CoreLogic’s research director, Tim Lawless, identified Perth as a stand out among the capital cities for a persistently rapid rate of capital gains.

“Perth home values rose a further 1.6% in January, on par with the city’s growth trend in November and December and only slightly lower than the recent high of 1.8% recorded in October. The western capital continues to see housing demand outweigh supply, helping to push values 16.7% higher over the past 12 months. Despite that, housing prices remain relatively affordable compared with most capital cities, with the median dwelling value sitting just under $677,000.”

Australians Prepared to Pay Premium for Houses Over Units

House values have continued rising at a faster rate relative to unit values in January, with the gap between the median capital city house and unit values rising to a record high of 45.2% in January.

Across the combined capitals, detached housing values rose by half a percent over the month, adding the equivalent of around $4,800 to the median house value while units increased a smaller 0.1%, equivalent to a $900 lift.

Regional Markets Strengthen

Regional markets are now showing a stronger trend in value growth relative to the capital cities. The combined regional index rose 1.2% over the rolling quarter compared with a 1.0% rise across the combined capitals index.

“While both the combined capitals and combined regional markets are losing momentum in the pace of value growth, the capital city trend has slowed more sharply, mostly due to the flattening of growth conditions in Melbourne and Sydney,” Mr Lawless said.

“Across the other states, regional WA, SA and Queensland continue to record a slower pace of growth relative to their capital city counterparts; these are also the three regional markets where dwelling values are at record highs.”

Choice of Properties Improving

Despite worsening housing affordability, the volume of home sales has held slightly above average over the past three months. CoreLogic estimates there were 115,241 dwellings sold over the three months ending January; 11.9% higher than the same period last year and 0.5% above the previous five-year average for this time of the year.